Asset-backed lending

Loan origination

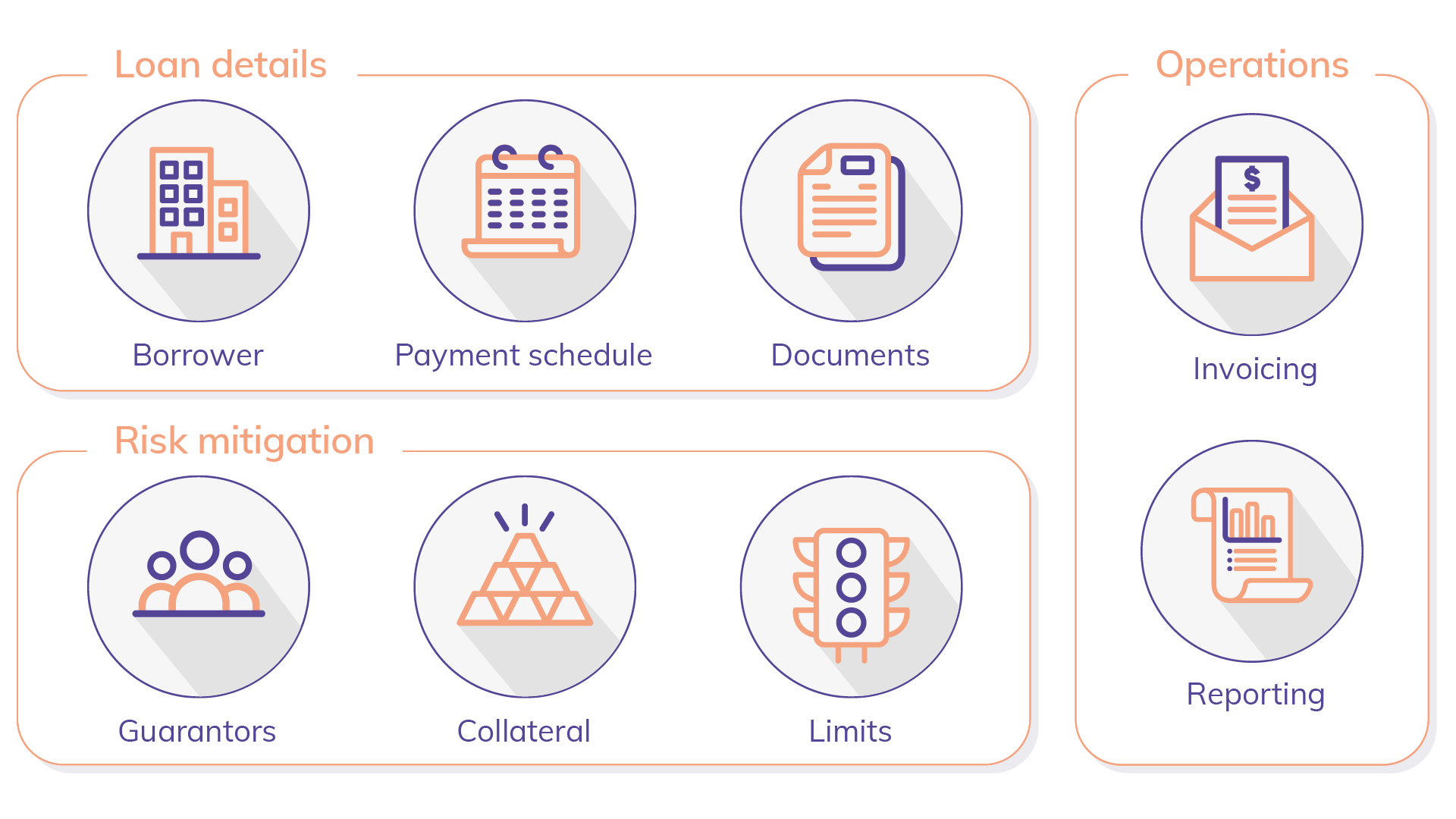

Silcube helps you quickly and accurately manage fixed and floating rate loans, including caps and floors, different principal amortization, interest accrual options, and many more. You can create loan agreements with attached documents, guarantors, and collateral, and invoice configuration is simplified as well. You can add loan attributes for reporting and configure risk limits for loans.

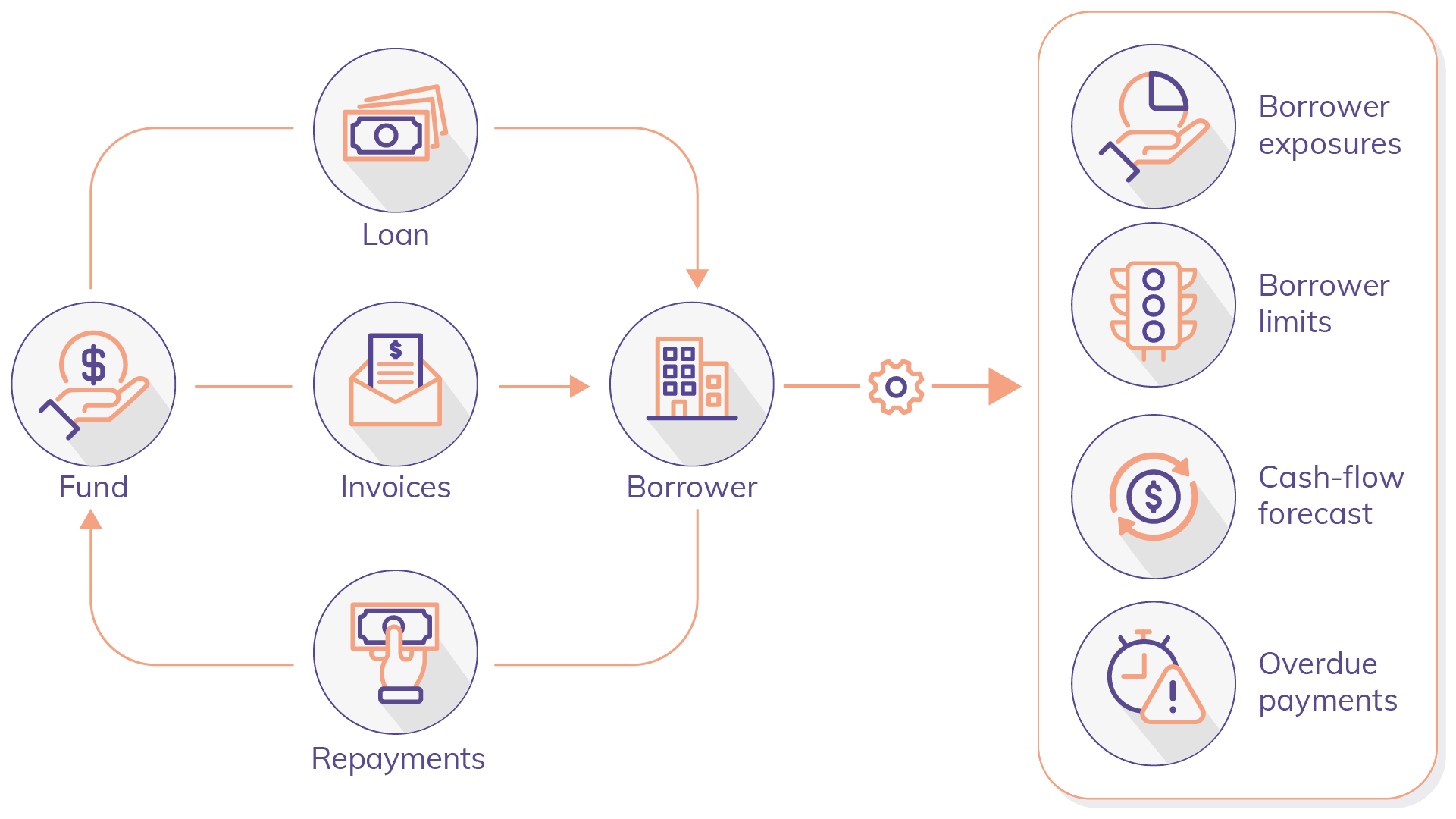

Loan management

Silcube’s real-time loan management system can help you stay on top of every loan book account, from creating invoices to monitoring overdue payments. Using a centralized dashboard, you can send invoices, schedule reminders for borrowers, and track payments without switching tabs.

If you adjust your payment schedule to reflect actual payments, Silcube will automatically recalculate all interest changes and principal amounts. With accurate calculations, you can simply add principals to existing loans, move them into a payment holiday, or liquidate them with a final payment.

User-defined attributes

.png?width=1921&height=1081&name=Custom%20classifiers%2016x9%20(1).png)

Silcube features a user-definable attributes system. You can classify assets and portfolios with attributes. You can storing time series data for the assets, such as impact and ESG KPIs. The attributes are used across the system for dashboards, risk management, exposure monitoring, and investor reporting.

.png?width=1921&height=1081&name=Custom%20classifiers%2016x9%20(1).png)

Dashboards for investors and stakeholders

Flexibility, efficiency, and robust data quality are crucial for reporting. Silcube’s customizable dashboards deliver on all three. You can combine financial metrics with non-financial metrics and add descriptive data.

ready to go digital?

Try before you buy with our risk-free trial.

Say goodbye to lengthy RFQs, pushy sales pitches, and dull demos.